The entry into force of the Value Added Tax Code (“the VAT Code”) is expected to be effective on the 1 of June 2023.

Suspended pursuant Law No. 3/2020 dated 14 April 2020, the VAT Code was amended by Decree-Law No. 21/2022 dated 19 July 2022, granting a Special regime with a reduced rate of 7% for companies with a turnover between 100,000 and 1,000,000 STN (approximately, EUR 4,081 and 40,816) and 2% for a turnover of less than 100,000 STN.

The standard rate of 15% will be reduced to 7.5% for certain basic products and foodstuffs.

The Consumption Tax of 5% on the net amount of the services provided and Stamp duties of 0,6% on gross amount paid on invoices will therefore be repealed with the coming into force of the Code, pursuant the dispositions of its Article 2.

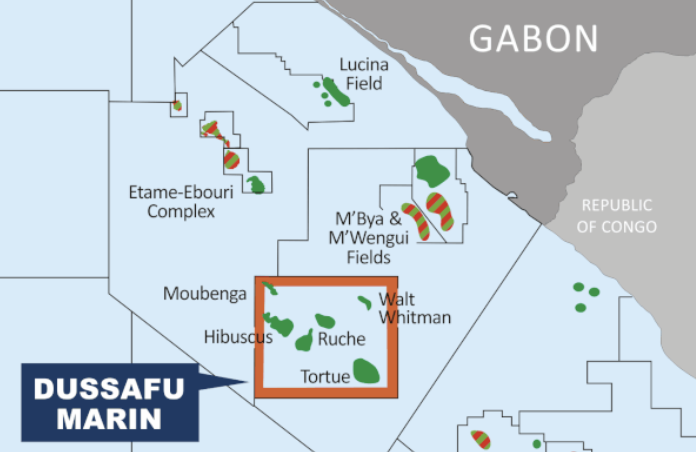

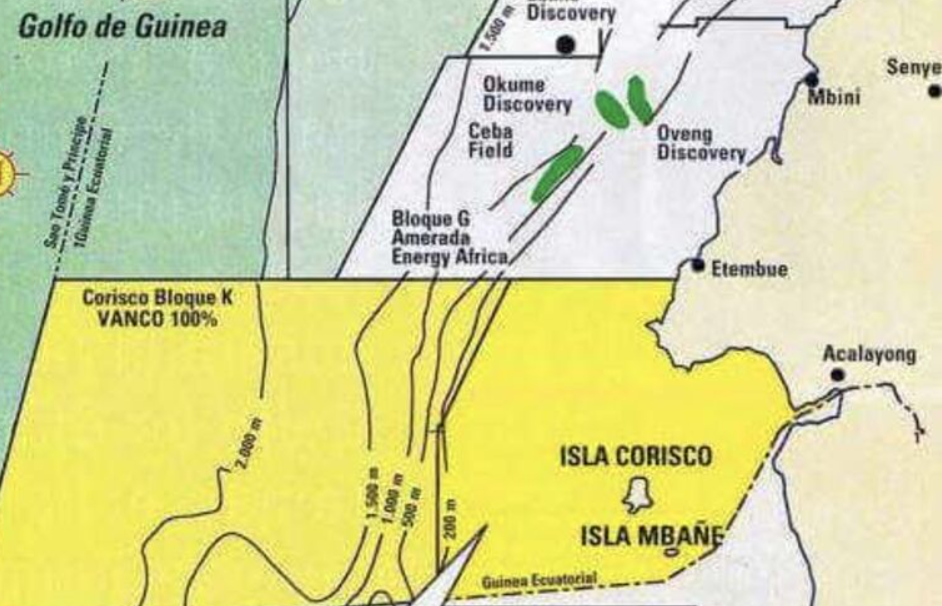

These amendments do not affect the conditions of application and exemptions for the Oil and Gas Regime which are defined in the Article 4.4 of the VAT code, as follows:

“Shall be excluded from the scope of application of paragraph 1, the transfer of goods, the provision of services and the import of goods in the exclusive economic zone and continental shelf when the customer carries out its main activity within the exploration and extraction of hydrocarbons.”